Week of April 28 Prep and 4/28 Plan

- Rishi Pahuja

- 6 hours ago

- 3 min read

First off, I'm really proud of my week last week. Not because of the return, but because of my commitment to and delivery of trade plans and recaps. This practice clearly helped me, and I'm excited to continue writing.

On to this week.

We still firmly have a downside bias on the weekly chart, while showing signs of a bottom. My base case is still a retest of the low before we ultimately choose a direction, but that base case is getting weaker. Last week created a bullish engulfing candle to get price back into the weekly ribbon. The stochastic indicates a likely mean reversion to the Weekly 21 is in play as well. There's no point in calling bottoms, rather create a plan on how I will react in different scenarios.

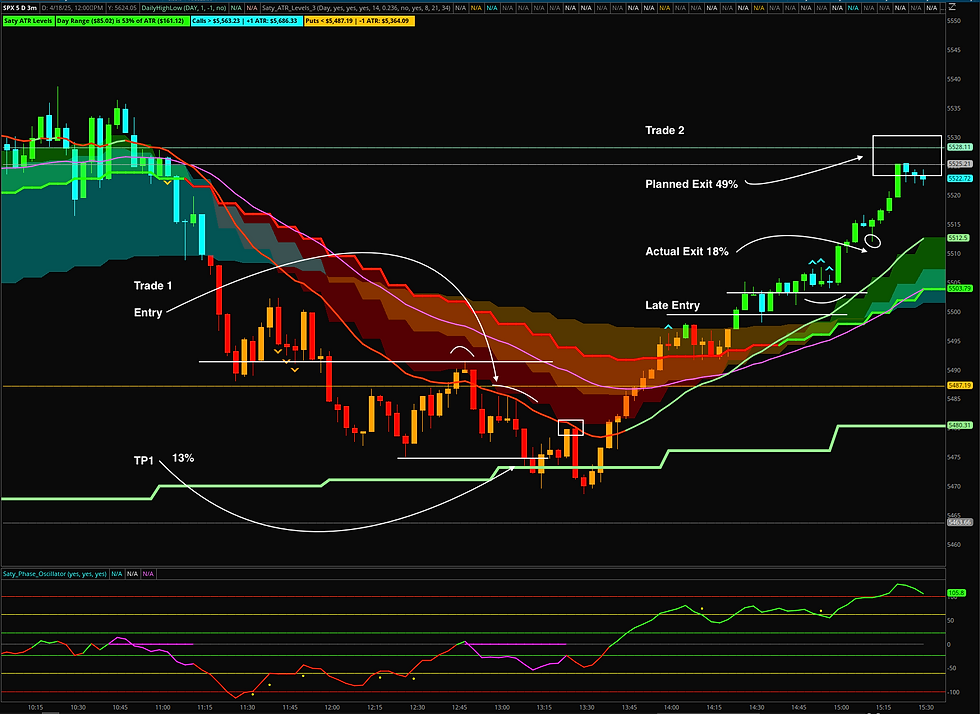

The daily chart is confirming this push to flip by starting to create a HH. The former high was put in on the 10% on April 9 that got price back to 5500ish / Quarterly Put Trigger / bear gap after the D21 rejected. Last week we started to break above that level, indicating the start of a potential shift. While we could continue higher from here, it's still likely we get a pullback to induce volume before a move up. So far the top of the bear gap and the D48 are acting as resistance, with the quarterly -618 aligning with last weeks bull gap.

The 4h chart shows this shift a little bit more clearly. 4h bias has turned positive and we've breached the former high. Again we can go higher from here, but at the very least I'd like to see a move into the ribbon, and the worst I'd want a retest of the previous higher low, maybe even a trap move below.

On the SPY chart, which is 23/5 and includes price / volume outside of RTH, the H chart shows some clear consolidation since the large move up on April 23. This is how markets work, longer period of consolidation, then aggressive moves in either direction.

This week there is a lot of market moving data being released. I could see the releases later in the week serving as a catalyst for a big move from the most recent consolidation. Given the week is loaded with news in the back half, we could see a smaller range for price Today and Tomorrow. Regardless, if there's a system trade, I will exit at the next level.

So, todays plan...

The hourly ribbon and structure are both firmly bullish, but we are seeing some bearish divergence. Just this morning we're testing the H48, but has held so far. Since the open the PWC is acting as clear resistance. At this point I wouldn't be surprised to see a move down to the multiday put trigger / Friday's LOD, which would be about a 20 point move down. We're not at resistance though, so nothing to do but wait right now!

Today's plan. Currently bearish but only to Friday's low. Optimal entry as always is in the ribbon. I will be extremely patient and wait for 2+ candles to close around the ribbon before considering an entry. Alternatively we could be setting up a trap down below the put trigger and a W bottom to move back to PDC. We could also do both! W bottom takes us to PDC / Ribbon and then we make it to Friday's low. I will be extra patient, and extra cautiously sized. I do not have to trade every day. And the back half of the week may present clearer setups given the news releases. Best not to use up all my mental capital / confidence while we're in hard mode!

Immediate bias down, puts at resistance only. Exit next level, period.

Comments